The Victoria Real Estate Board has released their latest statistics for the month of July. The following is an excerpt from their press release.

A total of 510 properties sold in the Victoria Real Estate Board region this July, 38.9 per cent fewer than the 835 properties sold in July 2021 and a 16.7 per cent decrease from June 2022. Sales of condominiums were down 39.4 per cent from July 2021 with 172 units sold. Sales of single family homes decreased 35.9 per cent from July 2021 with 254 sold.

"We’d previously indicated a shift in the local housing market,” said 2022 VREB President Karen Dinnie-Smyth. “This continued be the case in July as sales dipped, and we saw fewer listings come to the market, with more of the existing inventory remaining for sale. This slowdown means a calmer and more friendly environment with time for decision-making, which benefits sellers and buyers and will be a relief to many.”

There were 2,162 active listings for sale on the Victoria Real Estate Board Multiple Listing Service® at the end of July 2022, an increase of 5 per cent compared to the previous month of June and a 70.2 per cent increase from the 1,270 active listings for sale at the end of July 2021.

“As a result of the higher interest rates and inflation occurring right now, we see fluctuations in price and availability,” adds President Dinnie-Smyth. “Values will rise and fall over time, and historically local real estate values slowly increase over time, which means despite month-to-month variations, if you are buying a home, you have a sound, long-term investment. We need to remember that people don’t buy and sell on a month-to-month basis and that in the larger scheme of things, housing is more than numbers. A property is a place where people live their daily lives, raise their families, etc. It is more than a commodity, and for many it is the most important purchase they make in their lifetime. The government’s recent focus has been on demand-side mechanisms and other market modifiers such as a mandatory three-day cooling off period to start in 2023. A better long-term approach to housing affordability for our future is to address housing supply constraints which will be central to the next round of upward pressure on home prices. Consult with your REALTOR® to keep informed regarding current values and market conditions if you are in the market to buy or sell.”

The Multiple Listing Service® Home Price Index benchmark value for a single family home in the Victoria Core in July 2021 was $1,204,900. The benchmark value for the same home in July 2022 increased by 19 per cent to $1,433,800 but was down 2.1 per cent from June's value of $1,464,400. The MLS® HPI benchmark value for a condominium in the Victoria Core area in July 2021 was $502,600, while the benchmark value for the same condominium in July 2022 increased by 27.3 per cent to $639,600, down by 0.5 per cent from the June value of $643,100.

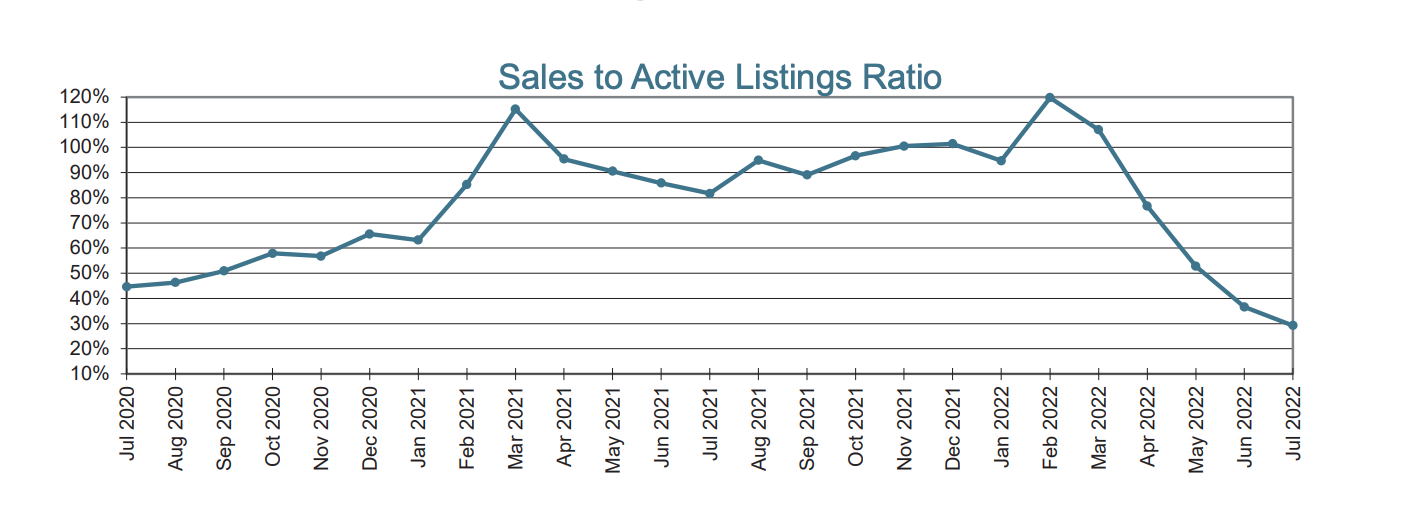

This chart tracks the ratio of total residential sales over total active residential listings at month-end for each of the last 25 months. The active listing count and the sales count can be viewed as indicators of housing supply and demand respectively. Observing the ratio between them can thus help indicate a "buyers' market", where there is downward pressure on prices, and a "sellers' market", where there is upward pressure on prices.

below 10%, there is downward pressure on prices (buyers' market)

above 25%, there is upward pressure on prices (sellers' market)

in the 15-20% range, there is little pressure on prices either way